Expert Tips To Help You Make An Informed Decision When Investing In Gold

Many people wonder what to do if the dollar collapses, well one of the answers is investing in gold now. When it comes to investing in gold, there are a lot of factors to consider. With so many different options available, it can be difficult to know which one is right for you. However, by taking the time to do your research and educate yourself on the various aspects of gold investing, you can make an informed decision that will best suit your needs. To help you get started, we’ve compiled a list of expert tips from seasoned investors. Gold investing doesn’t have to be complicated – read on for everything you need to know!

Contents

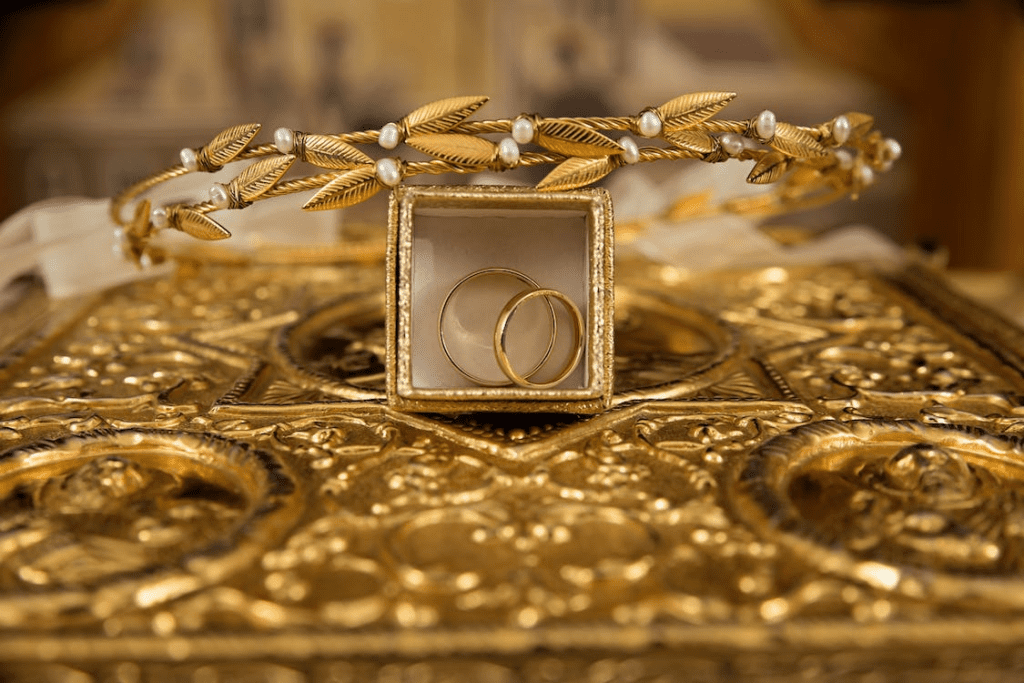

Know what you’re buying – not all gold is created equal

If you’ve ever heard the phrase ‘not all that glitters is gold’, that adage of wisdom can especially be applied to gold jewelry. In the marketplace, there exists a variety of gold components made from different carats.

Pure gold is 24 karat while 10 and 18 karats are common in commercial stores. Knowing this ahead of time allows you and your jeweler to determine the right grade to suit your budget and needs. Different amounts come with different price tags, so make sure you know exactly what you’re buying before signing on the dotted line!

Consider the costs of storage and insurance

When it comes to protecting valuables you own, storage and insurance should be just as important as the item itself. But of course, that protection comes with a price tag – both in terms of money and effort.

Depending on the item, what kind of cover you need, and how secure a space you require for storage, costs can quickly add up when considering the space-rental fees and premiums on the insurance. It’s important to research thoroughly before making any decisions so that you don’t accidentally overspend or end up with inadequate coverage. As careful buyers, we need to ensure we’re getting maximum value for our investment on both fronts.

Be aware of the risks involved in gold ownership

Owning gold is often considered a safe and secure way to store wealth, but it’s important to be aware of the risks involved. Investing in gold carries with it certain financial, political and practical risks worth noting. On the financial side, gold prices can rise or fall based on global market conditions, which means that when times are good, you may make a profit off your investments—but bad market conditions can lead to losses.

Politically, governments may impose restrictions on the purchase or ownership of gold in tumultuous times; these restrictions can significantly impact the value and liquidity of your gold investments. Finally, physical gold holdings also come with practical considerations—they need to be stored in secure locations and properly insured against theft or damage. Being aware of all these risks helps ensure you make informed decisions about investing in gold.

Understand the tax implications of investing in gold

Investing in gold can be an important part of a well-diversified portfolio, but before you jump in and allocate your hard-earned money, it’s important to understand the types of Gold IRA accounts available, as well as the tax implications that come with investing in gold. For example, if you buy physical gold or coins, be aware that different forms of gold are taxed differently.

Some are taxed either as collectible investments, subject to different rules and higher taxes than normal investments; while others are considered investment bullion and are taxed differently. Additionally, different types of Gold IRA accounts — such as traditional Gold IRAs or self-directed Gold IRAs – have different provisions for taxation and rollover rules. Understanding these different tax implications will help you make better-informed decisions about your investment strategies going forward.

Diversify your investment portfolio to minimize risk

When it comes to investing, diversifying your portfolio is one of the surest and safest strategies you can use to minimize risk. Although decisions based solely on emotion can be tempting, think like a professional investor and spread yourself out: don’t put all your eggs in one basket.

Explore stocks, bonds, mutual funds, and other investments―including alternative options such as art or precious metals―so you have diverse areas that could benefit from market improvement. Keep an eye on news and trends in the market to help inform your next steps; more diversity could bring more stability if done correctly.

The best times to sell gold investments

If you’re looking to sell your gold investments, timing can be everything. Generally, the best times to make a sale are when prices are at their peak. This means paying close attention to the markets and understanding how they work.

When it comes to gold, there are a few key indicators that can help you determine if now is a good time to sell. These include general market conditions, geopolitical shifts, and supply and demand.

First, consider the state of the overall stock markets. Gold prices tend to rise during periods of volatility or uncertainty in other markets—such as when investors are worried about political unrest, currency devaluation, or increased inflation. So if you’re seeing signs of market turmoil, this could be a good time to sell your gold investments.

Next, pay attention to geopolitical events and news stories that may affect gold prices. If a major event is likely to increase demand for gold—such as an economic crisis or international conflict—this could create an opportunity for investors to cash in on the spike in prices.

Finally, monitor supply and demand. Gold is a finite resource, so if there’s an increase in demand for gold but a limited supply, this could mean that prices are likely to rise. On the other hand, if demand for gold drops or new discoveries of gold emerge, this could cause prices to decline.

When you’re ready to add gold to your investment portfolio, do your homework first and choose reputable dealers or brokers. Work with them to create a plan that meets your specific goals and diversifies your investments to minimize risk. And finally, be aware of the risks—and costs—of owning gold so you can make informed decisions about how best to protect and grow your wealth.